Daftar Isi

In an era where convenience and speed drive our daily interactions, Apple Pay emerges as a trailblazer in the world of contactless payment. As we navigate a landscape increasingly devoid of physical wallets, Apple Pay’s seamless integration with our iPhones, Apple Watches, and iPads has revolutionized how we transact. Let’s delve into the present and future of this transformative payment method.

The Rise of Apple Pay: A Contactless Revolution

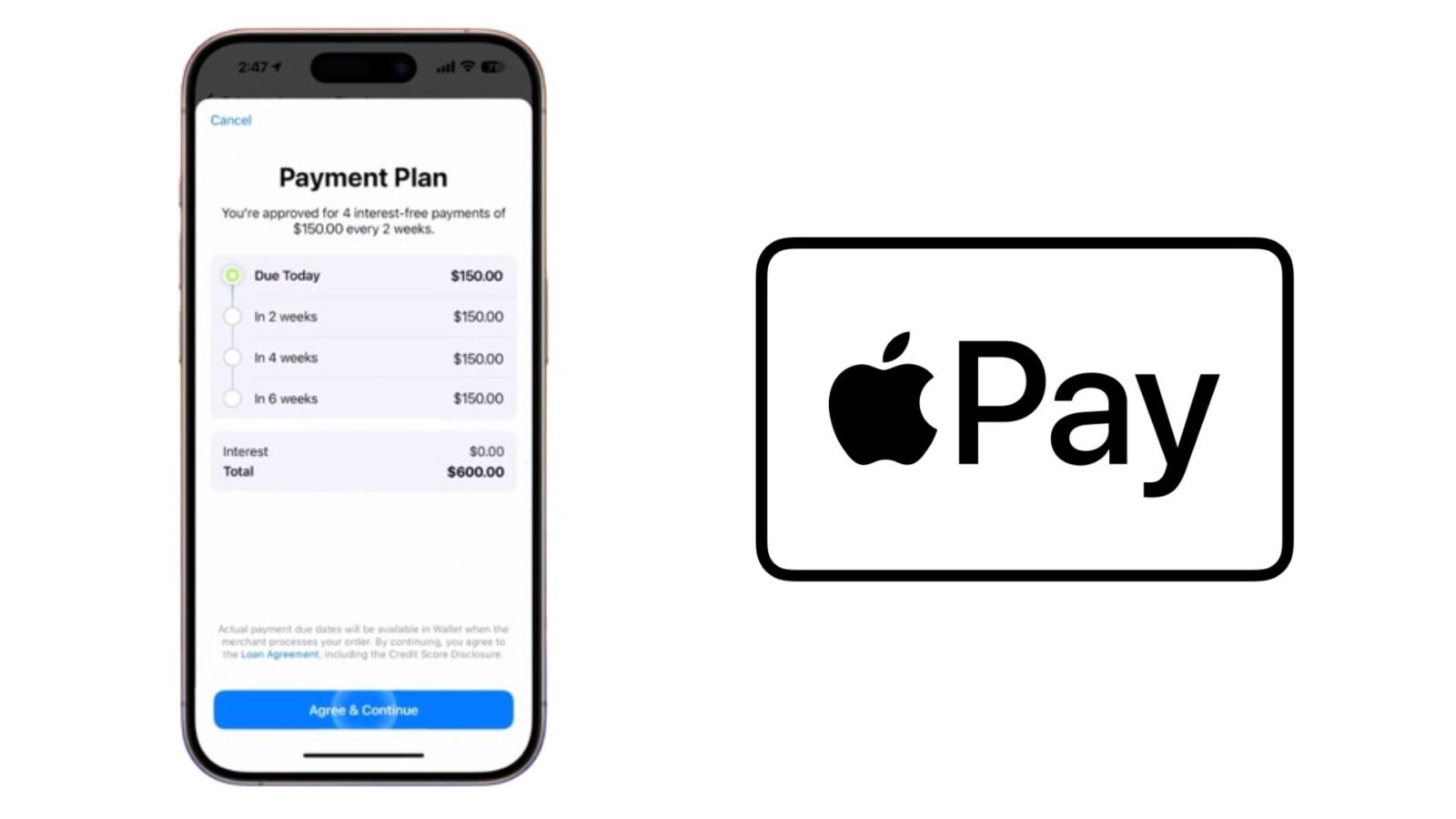

Apple Pay’s inception in 2014 marked a pivotal moment in the financial industry. By leveraging near-field communication (NFC) technology, Apple transformed our devices into digital wallets. The process is elegantly simple: Hold your iPhone near a payment terminal, authenticate with Face ID or Touch ID, and voilà—the transaction is complete. No more fumbling for cards, no more PINs to remember. Whether you’re buying groceries, boarding a train, or donating to a charity, Apple Pay streamlines the process, making it faster and more secure.

But Apple Pay’s impact extends beyond convenience. It champions privacy and security. When you add a card to Apple Pay, it generates a unique Device Account Number (DAN) for that card. Your actual card details remain hidden, shielding you from potential breaches. Additionally, biometric authentication ensures that only you can authorize transactions. As cyber threats loom large, Apple Pay’s robust security measures provide peace of mind.

Read More: Apple Watch Ultra 2: Best Build Quality Meets Enhanced Technology

The Future Unfolds: What’s New in Apple Pay

Recurring Payments and Auto Reload

With the release of iOS 17, Apple Pay is introducing a game-changing feature: recurring payments. Now, imagine the convenience of effortlessly handling your monthly subscriptions, from streaming services like Netflix and Spotify to your go-to fitness app. With just a few taps, users can set up recurring payments through Apple Pay, eliminating the hassle of manually processing transactions each month. Once configured, Apple Pay takes care of the payments automatically, allowing users to focus on enjoying their subscriptions without worrying about payment deadlines.

But that’s not all—Apple Cash is also getting an upgrade with auto reload functionality. Gone are the days of constantly monitoring your balance and reloading funds manually. With auto reload, your Apple Cash balance replenishes automatically whenever it runs low, ensuring that you always have funds available for your purchases and transactions. This feature provides users with peace of mind, knowing that they can seamlessly access and use their Apple Cash without interruption.

Together, these features represent a significant step forward in simplifying financial management for iOS users. By automating recurring payments and enabling auto reload for Apple Cash, iOS 17 empowers users to take control of their finances with ease and convenience. Whether it’s managing subscriptions or ensuring sufficient funds for everyday transactions, iOS 17 makes financial management effortless and stress-free.

Tap to Present ID on iPhone

In an exciting development slated for later this year, Apple Pay is set to redefine how we present identification documents. Picture this: your driver’s license or ID securely stored in the Wallet app on your iPhone. With the innovative “Tap to Present ID” feature, your iPhone becomes your trusted identity verifier at participating businesses and venues.

This revolutionary feature has far-reaching implications, offering a seamless and secure way to verify your identity in various scenarios. Whether you’re purchasing age-restricted items, renting a car, or checking into a hotel, all it takes is a simple tap of your iPhone to confirm your credentials.

The introduction of “Tap to Present ID” underscores Apple Pay’s evolution beyond its traditional role as a payment platform. By leveraging the secure and convenient infrastructure of the Wallet app, Apple Pay is expanding its capabilities to encompass digital identification, offering users a versatile and efficient solution for everyday transactions.

With security and privacy at the forefront, Apple Pay’s implementation of digital ID aims to provide users with a reliable and secure method of authentication, eliminating the need for physical identification cards and streamlining the verification process.

As Apple continues to innovate and expand the capabilities of its ecosystem, “Tap to Present ID” represents another milestone in the evolution of digital identity, offering users a convenient and secure way to verify their identity in an increasingly digital world.

Conclusion: A Cashless Tomorrow

As we embrace a cashless future, Apple Pay stands at the forefront. Its seamless experience, robust security, and innovative features redefine how we interact with money. With over 500 million users globally, Apple Pay isn’t just a payment method; it’s a lifestyle. So, next time you tap your iPhone to pay, remember—you’re part of a revolution.

Up-to-Date Data: As of September 2023, Apple Pay boasts over 500 million users worldwide, solidifying its position as the future of contactless payment1. Its continuous evolution promises even greater convenience and security for generations to come.